Unlocking The Potential Of First Insurance Funding: A Comprehensive Guide

Mar 24 2025

First insurance funding has become a critical financial tool for businesses and individuals alike, offering innovative solutions to manage insurance premiums effectively. In today’s fast-paced world, where cash flow management is paramount, this funding option provides a flexible and accessible way to pay for insurance expenses without depleting your operating capital. By understanding the nuances of first insurance funding, you can unlock its full potential and enhance your financial stability.

For businesses of all sizes, insurance premiums can represent a significant financial burden, especially when paid upfront. First insurance funding addresses this challenge by allowing policyholders to spread out their payments over time, making it easier to budget and allocate resources efficiently. This method not only improves cash flow but also ensures that businesses remain compliant with their insurance obligations without compromising their financial health.

In this article, we delve deep into the world of first insurance funding, exploring its benefits, how it works, and why it’s a smart financial decision. Whether you’re a business owner, a finance professional, or an individual seeking to optimize your insurance expenses, this guide will equip you with the knowledge and tools to make informed decisions. Let’s explore how first insurance funding can transform the way you approach insurance financing.

Read also:Mollys Suds Vs Charlies Soap The Ultimate Clean Comparison

What Is First Insurance Funding?

First insurance funding refers to a financial arrangement where a third-party lender pays the insurance premium on behalf of the policyholder. The policyholder then repays the lender over an agreed period, often with interest. This mechanism alleviates the immediate financial strain of paying large insurance premiums upfront and allows businesses to allocate their resources more strategically.

One of the key advantages of first insurance funding is its flexibility. Unlike traditional loans, this funding option is specifically tailored to cover insurance expenses, ensuring that businesses remain compliant with their insurance requirements while maintaining liquidity. It’s particularly beneficial for industries with high insurance costs, such as construction, healthcare, and transportation, where large premiums can strain cash flow.

How Does First Insurance Funding Work?

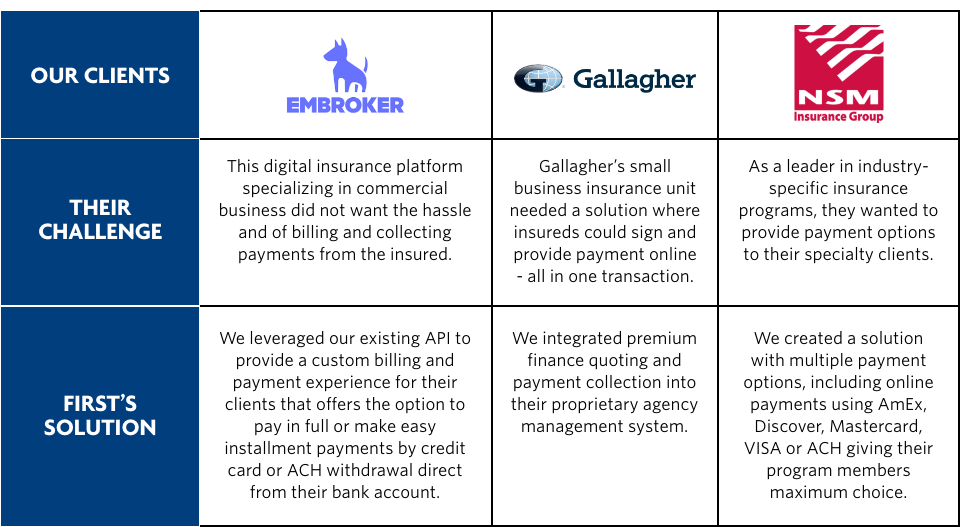

The process of first insurance funding is straightforward and involves three main parties: the policyholder, the insurance provider, and the funding company. Initially, the policyholder selects an insurance policy and determines the premium amount. The funding company then steps in to pay the premium directly to the insurance provider. The policyholder subsequently repays the funding company in installments, typically over a 10- or 12-month period.

This arrangement offers several benefits, including improved cash flow management, reduced financial strain, and enhanced financial planning capabilities. By spreading out the cost of insurance premiums, businesses can avoid the cash flow disruptions that often accompany large, upfront payments.

Why Choose First Insurance Funding?

When considering insurance financing options, first insurance funding stands out as a viable and advantageous choice. Here are some compelling reasons to opt for this funding method:

- Improved Cash Flow: By deferring the upfront payment of insurance premiums, businesses can maintain a healthier cash flow and allocate funds to other critical areas.

- No Collateral Required: Unlike traditional loans, first insurance funding typically does not require collateral, making it accessible to businesses of all sizes.

- Customizable Repayment Plans: Funding companies offer flexible repayment terms, allowing businesses to tailor the arrangement to their specific needs.

Is First Insurance Funding Right for Your Business?

Before committing to first insurance funding, it’s essential to evaluate whether it aligns with your business’s financial goals and needs. Consider factors such as your current cash flow situation, the size of your insurance premiums, and your ability to meet repayment obligations. For many businesses, especially those with seasonal cash flow fluctuations, first insurance funding can be a game-changer.

Read also:Unveiling The Buzz Around The Breckie Hill Shower Video A Deep Dive

What Are the Benefits of First Insurance Funding?

First insurance funding offers numerous benefits that make it an attractive option for businesses seeking to optimize their financial resources. Some of the key advantages include:

- Enhanced Financial Stability: By spreading out insurance payments, businesses can avoid the financial shocks associated with large, upfront premiums.

- Increased Flexibility: Businesses can use the freed-up capital for other operational expenses, investments, or growth opportunities.

- Improved Credit Management: First insurance funding does not typically impact your credit score, making it a safer option for businesses with existing credit obligations.

Can First Insurance Funding Be Customized?

Yes, first insurance funding can be customized to suit the specific needs of your business. Funding companies often offer a range of repayment terms, interest rates, and payment schedules to ensure that the arrangement aligns with your financial goals. This flexibility allows businesses to choose a plan that best fits their cash flow and budgetary requirements.

How Much Does First Insurance Funding Cost?

The cost of first insurance funding varies depending on factors such as the premium amount, the repayment period, and the interest rate charged by the funding company. Typically, businesses can expect to pay a small fee or interest on the funded amount. It’s crucial to compare offers from different funding providers to secure the most favorable terms.

What Are the Risks Associated with First Insurance Funding?

While first insurance funding offers numerous benefits, it’s important to be aware of potential risks. These may include higher overall costs due to interest charges, the obligation to meet repayment schedules, and the possibility of penalties for late payments. To mitigate these risks, it’s advisable to thoroughly review the terms and conditions of the funding agreement and ensure that you can comfortably meet the repayment obligations.

Is First Insurance Funding Suitable for All Businesses?

First insurance funding is generally suitable for businesses with predictable cash flow and the ability to meet repayment obligations. However, it may not be the best option for businesses with unstable or unpredictable cash flow. It’s important to assess your financial situation carefully and consult with financial advisors if necessary before committing to this funding option.

How to Apply for First Insurance Funding?

Applying for first insurance funding is a straightforward process that typically involves the following steps:

- Identify Your Insurance Needs: Determine the type and amount of insurance coverage required for your business.

- Choose a Funding Provider: Research and select a reputable funding company that offers competitive terms and conditions.

- Submit Your Application: Provide the necessary documentation, such as insurance policy details and financial statements, to the funding company.

- Finalize the Agreement: Once approved, review and sign the funding agreement, ensuring that you understand all terms and conditions.

What Should You Look for in a First Insurance Funding Provider?

When selecting a first insurance funding provider, consider factors such as reputation, experience, and customer reviews. Look for a provider that offers transparent terms, competitive interest rates, and flexible repayment options. Additionally, ensure that the provider is licensed and compliant with relevant financial regulations.

Can First Insurance Funding Be Used for Personal Insurance?

While first insurance funding is primarily designed for businesses, some providers may offer similar solutions for personal insurance policies. This can be particularly beneficial for individuals with high insurance premiums, such as those for health, life, or property insurance. If you’re considering this option, it’s important to research providers that specialize in personal insurance funding and evaluate the terms carefully.

Conclusion

First insurance funding offers a practical and effective solution for businesses and individuals seeking to manage their insurance expenses more efficiently. By deferring upfront payments and spreading out costs over time, this funding option enhances cash flow, improves financial stability, and provides greater flexibility in resource allocation. As you explore the possibilities of first insurance funding, remember to assess your financial needs, compare offers from different providers, and choose a plan that aligns with your long-term goals.

Table of Contents

- What Is First Insurance Funding?

- How Does First Insurance Funding Work?

- Why Choose First Insurance Funding?

- Is First Insurance Funding Right for Your Business?

- What Are the Benefits of First Insurance Funding?

- Can First Insurance Funding Be Customized?

- How Much Does First Insurance Funding Cost?

- What Are the Risks Associated with First Insurance Funding?

- Is First Insurance Funding Suitable for All Businesses?

- How to Apply for First Insurance Funding?