Unveiling The Role And Functions Of The Connecticut Department Of Revenue Services

Mar 23 2025

The Connecticut Department of Revenue Services (DRS), commonly referred to as the department of revenue ct, plays a pivotal role in managing the financial health of the state. Established to ensure transparency and accountability, this department oversees taxation, licensing, and regulatory compliance. From administering state taxes to enforcing revenue laws, the department of revenue ct ensures that funds are collected efficiently and allocated appropriately for public welfare. In this article, we will explore its key responsibilities, structure, and significance in maintaining Connecticut's economic stability.

As a taxpayer or business owner in Connecticut, understanding the functions of the department of revenue ct is essential. This governmental body works tirelessly to ensure that revenue systems are fair, efficient, and compliant with state laws. Its mission is to provide quality service while fostering trust and cooperation with taxpayers. Through advanced technology and a commitment to transparency, the department of revenue ct continues to evolve, meeting the needs of a growing population and dynamic economy.

For those seeking clarity on tax obligations or regulatory compliance, the department of revenue ct serves as a crucial resource. Whether you're filing income taxes, registering a business, or seeking refunds, this department offers comprehensive guidance and support. By examining its operations and initiatives, we can better appreciate how it contributes to Connecticut's fiscal health and overall prosperity.

Read also:Skirby Your Ultimate Guide To This Emerging Trend

What Are the Key Responsibilities of the Department of Revenue CT?

Understanding the responsibilities of the department of revenue ct is crucial for anyone living or operating a business in Connecticut. This department handles a wide array of functions, from collecting taxes to ensuring compliance with state regulations. One of its primary roles is administering state taxes, including income, sales, and corporate taxes. Additionally, it manages licensing and registration processes for businesses, ensuring that all entities adhere to state laws.

Another significant responsibility is enforcing revenue laws and addressing violations. The department of revenue ct employs a team of auditors and investigators who identify discrepancies and ensure accurate reporting. Through regular audits and compliance checks, the department safeguards the state's financial interests and maintains public trust. Furthermore, it offers educational resources and support to help taxpayers and businesses understand their obligations and rights.

Modernizing its operations, the department of revenue ct has embraced digital tools to enhance efficiency and accessibility. Online platforms allow for seamless filing of taxes, applications, and inquiries, making it easier for residents and businesses to interact with the department. This commitment to innovation ensures that the department remains responsive to the evolving needs of its constituents.

How Does the Department of Revenue CT Support Small Businesses?

Small businesses form the backbone of Connecticut's economy, and the department of revenue ct plays a vital role in supporting their growth and success. By offering tailored resources and services, the department helps entrepreneurs navigate the complexities of taxation and regulatory compliance. For instance, it provides detailed guides on tax obligations, licensing requirements, and financial planning, empowering small business owners to make informed decisions.

Moreover, the department of revenue ct conducts workshops and seminars aimed at educating business owners about best practices in financial management. These initiatives not only enhance compliance but also contribute to the long-term sustainability of small enterprises. By fostering a supportive environment, the department encourages innovation and entrepreneurship, driving economic development across the state.

In addition to educational programs, the department offers specialized assistance to small businesses facing financial challenges. This includes guidance on tax relief programs, deferred payment plans, and other financial aids. Such measures demonstrate the department's commitment to nurturing a thriving business community in Connecticut.

Read also:Bill Gates In Kenya A Comprehensive Exploration Of His Work And Impact

Why Is Transparency Important for the Department of Revenue CT?

Transparency is a cornerstone of the department of revenue ct's operations, ensuring accountability and trust between the government and its citizens. By openly sharing information about its processes, policies, and decision-making, the department builds confidence in its ability to manage public funds responsibly. This commitment to transparency is evident in its regular publication of financial reports, audit results, and performance metrics.

Furthermore, the department of revenue ct utilizes digital platforms to enhance accessibility and engagement. Its website serves as a hub for resources, updates, and interactive tools, allowing taxpayers and businesses to stay informed and involved. Through these initiatives, the department fosters a culture of openness and collaboration, reinforcing its role as a trusted partner in Connecticut's fiscal landscape.

Transparency also extends to the department's enforcement actions and compliance programs. By clearly communicating its standards and expectations, the department of revenue ct ensures that all stakeholders understand their responsibilities and rights. This approach not only enhances compliance but also strengthens the overall integrity of the state's revenue system.

What Services Does the Department of Revenue CT Offer?

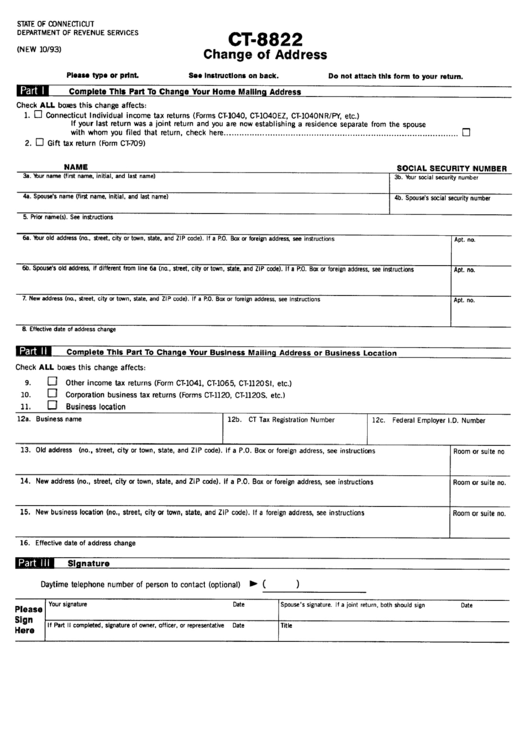

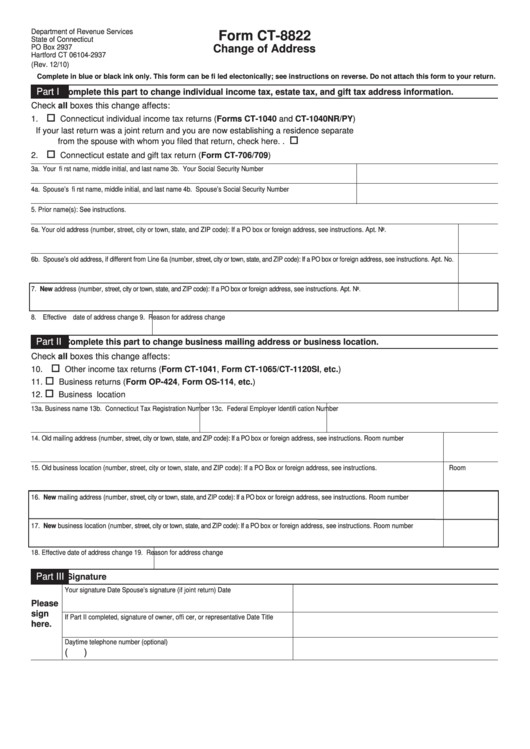

The department of revenue ct provides a wide range of services designed to meet the diverse needs of Connecticut residents and businesses. From tax filing assistance to licensing support, its offerings aim to simplify and streamline financial interactions with the state government. Key services include online tax filing, business registration, and payment processing, all accessible through user-friendly digital platforms.

- Online Tax Filing: Residents can conveniently file their state taxes through the department's secure portal, reducing paperwork and processing times.

- Business Registration: Entrepreneurs can register their businesses and obtain necessary licenses through a centralized system, ensuring compliance with state regulations.

- Payment Processing: The department facilitates easy payment of taxes, fees, and penalties through various payment methods, including credit cards and electronic funds transfers.

Additionally, the department of revenue ct offers specialized services for specific groups, such as veterans, seniors, and low-income individuals. These programs aim to provide tailored support and relief, addressing the unique financial needs of these communities.

Can You Explain the Structure of the Department of Revenue CT?

The structure of the department of revenue ct is designed to ensure efficient and effective management of its diverse functions. Comprising several divisions and offices, each unit focuses on specific aspects of revenue administration and compliance. At the helm is the Commissioner, who oversees the department's overall strategy and operations, ensuring alignment with state objectives and priorities.

Key divisions within the department include Tax Administration, Compliance, and Information Technology. The Tax Administration Division handles tax policy development, implementation, and education, while the Compliance Division focuses on enforcement and auditing. The Information Technology Division supports these efforts by maintaining and enhancing the department's digital infrastructure, ensuring seamless operations and accessibility.

This hierarchical structure allows the department of revenue ct to address complex issues promptly and effectively. By fostering collaboration and communication between divisions, the department ensures that its services remain responsive to the evolving needs of Connecticut's residents and businesses.

How Can Residents Stay Informed About Department of Revenue CT Updates?

Staying informed about the latest developments and updates from the department of revenue ct is essential for residents and businesses alike. The department offers multiple channels for communication and engagement, ensuring that stakeholders remain up-to-date on important announcements and policy changes. Its official website serves as the primary source of information, featuring news releases, FAQs, and contact details for customer support.

Residents can also subscribe to email alerts and newsletters, receiving timely updates on tax deadlines, new programs, and compliance requirements. Social media platforms provide another avenue for engagement, allowing the department to share information and interact with the public in real-time. By leveraging these tools, the department of revenue ct enhances accessibility and fosters a more informed and engaged community.

In addition to digital channels, the department hosts public meetings and forums, inviting feedback and input from stakeholders. These initiatives demonstrate its commitment to transparency and collaboration, ensuring that the needs and concerns of Connecticut's residents and businesses are heard and addressed.

What Initiatives Is the Department of Revenue CT Currently Undertaking?

The department of revenue ct is actively pursuing several initiatives aimed at enhancing its services and improving fiscal management across the state. One major focus is the modernization of its digital infrastructure, investing in advanced technology to streamline operations and enhance user experience. This includes upgrading online platforms, expanding mobile accessibility, and implementing data analytics tools to improve decision-making and resource allocation.

Another key initiative is the expansion of taxpayer education programs, targeting underserved communities and promoting financial literacy. Through partnerships with local organizations and educational institutions, the department aims to reach a broader audience, providing resources and support to those in need. These efforts not only enhance compliance but also contribute to the overall economic well-being of Connecticut's residents.

Furthermore, the department of revenue ct is committed to environmental sustainability, exploring green initiatives to reduce its carbon footprint. This includes adopting eco-friendly practices in its offices and promoting energy-efficient solutions for businesses and homeowners. By prioritizing sustainability, the department demonstrates its dedication to responsible stewardship and long-term prosperity.

How Does the Department of Revenue CT Ensure Compliance?

Ensuring compliance is a critical function of the department of revenue ct, achieved through a combination of proactive measures and enforcement actions. The department employs a team of experienced auditors and investigators who conduct regular reviews and inspections, identifying potential violations and addressing them promptly. By maintaining rigorous standards and procedures, the department safeguards the integrity of Connecticut's revenue system.

In addition to audits, the department of revenue ct utilizes advanced data analytics to detect anomalies and patterns indicative of non-compliance. This technology-driven approach enhances efficiency and accuracy, allowing for targeted interventions and resolutions. Through these efforts, the department not only enforces existing laws but also educates taxpayers and businesses about their obligations, fostering a culture of compliance and responsibility.

Furthermore, the department offers amnesty programs and settlement options for those seeking to resolve outstanding issues. These initiatives demonstrate its commitment to fairness and cooperation, encouraging voluntary compliance and reducing the burden on enforcement resources. By balancing enforcement with education and support, the department of revenue ct ensures that all stakeholders fulfill their responsibilities effectively.

What Challenges Does the Department of Revenue CT Face?

Like any governmental entity, the department of revenue ct faces numerous challenges in fulfilling its mission and responsibilities. One significant challenge is adapting to the rapidly evolving landscape of taxation and technology. As new forms of commerce and financial transactions emerge, the department must continually update its policies and systems to remain effective and relevant. This requires significant investment in training, infrastructure, and innovation.

Another challenge is addressing resource constraints while meeting increasing demands for services and support. With a growing population and expanding economy, the department must balance efficiency with accessibility, ensuring that all residents and businesses receive the assistance they need. This often involves prioritizing initiatives and reallocating resources to maximize impact and reach.

Finally, the department of revenue ct must navigate complex legal and regulatory environments, balancing compliance with innovation and flexibility. By fostering collaboration with stakeholders and embracing best practices, the department continues to overcome these challenges, maintaining its position as a leader in revenue management and public service.

Conclusion: The Impact of the Department of Revenue CT

The department of revenue ct plays a vital role in shaping Connecticut's economic landscape, ensuring that funds are collected, managed, and allocated effectively for public benefit. Through its commitment to transparency, innovation, and collaboration, the department enhances compliance, fosters trust, and promotes prosperity across the state. By understanding its functions and initiatives, residents and businesses can better appreciate its contributions and engage meaningfully with its services.

As the department of revenue ct continues to evolve, addressing emerging challenges and embracing new opportunities, it remains dedicated to serving the needs of Connecticut's diverse communities. By prioritizing education, sustainability, and accessibility, the department ensures that its services remain relevant and impactful, contributing to the state's long-term success and well-being.

Table of Contents

- What Are the Key Responsibilities of the Department of Revenue CT?

- How Does the Department of Revenue CT Support Small Businesses?

- Why Is Transparency Important for the Department of Revenue CT?

- What Services Does the Department of Revenue CT Offer?

- Can You Explain the Structure of the Department of Revenue CT?

- How Can Residents Stay Informed About Department of Revenue CT Updates?

- What Initiatives Is the Department of Revenue CT Currently Undertaking?

- How Does the Department of Revenue CT Ensure Compliance?

- What Challenges Does the Department of Revenue CT Face?

- Conclusion: The Impact of the Department of Revenue CT